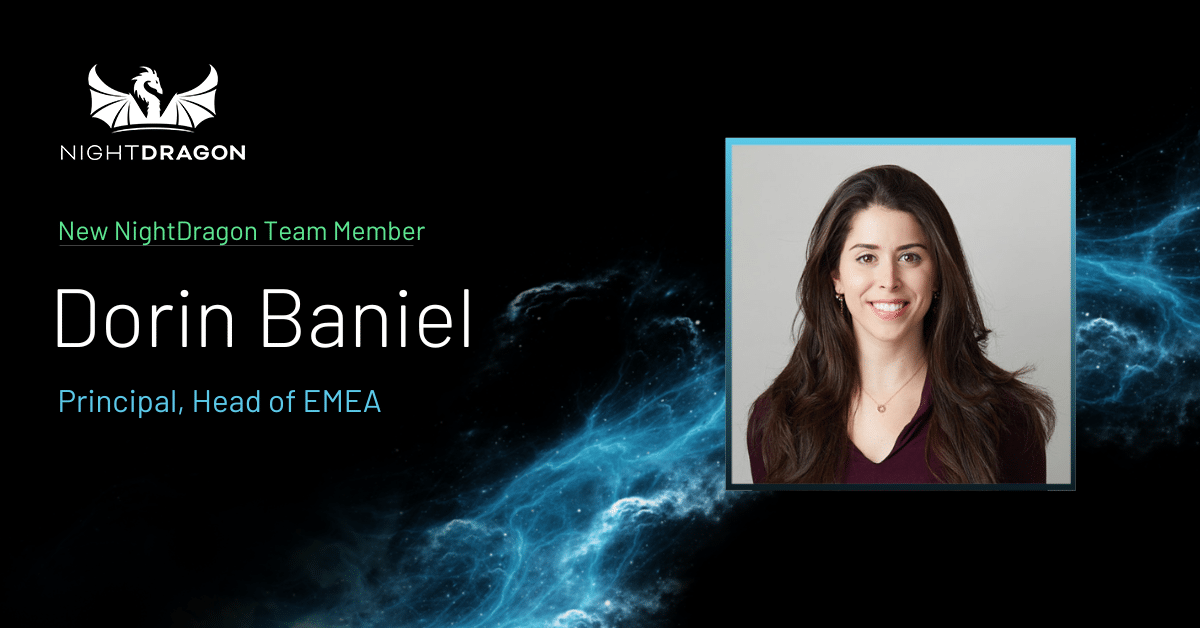

My favorite quote has always been: “If opportunity doesn’t knock, build a door.”

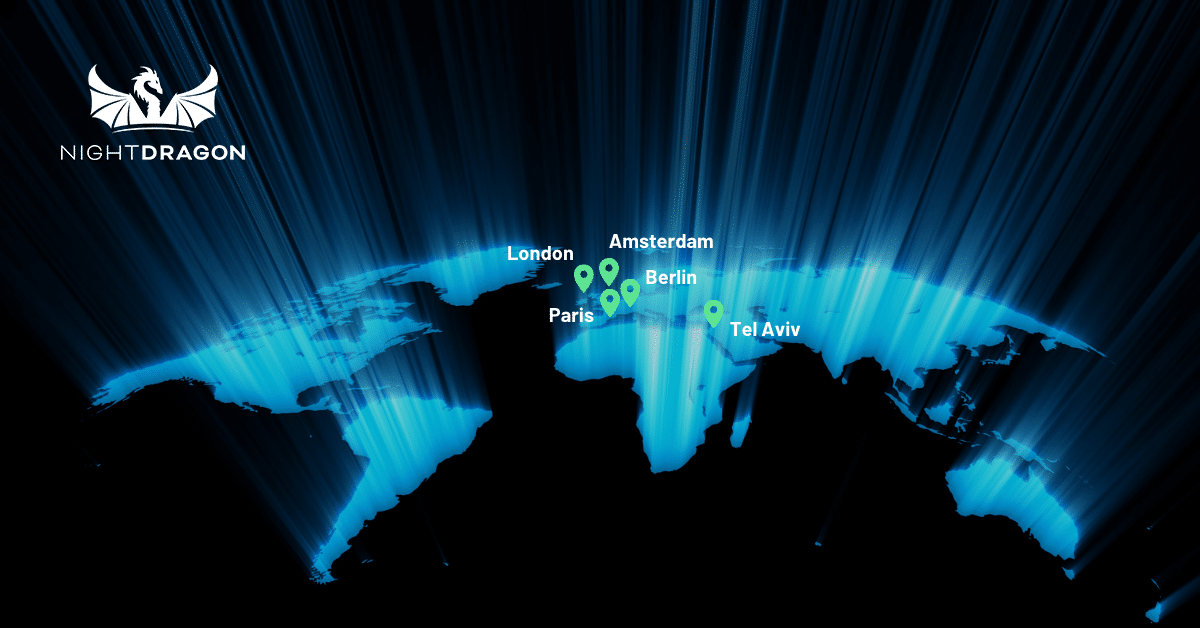

As an Israeli-American with a passion for all things tech, I am filled with excitement as I join the NightDragon team as we expand our presence in EMEA and open our first international office in Tel Aviv. Surrounded by the extraordinary talent within the NightDragon team and a robust network of Advisors and industry leaders, we set forth to build this door for Founders in EMEA to scale their fast-growing cybersecurity, security, safety and privacy (CSSP) startups into global, multi-billion-dollar businesses set to secure our world for tomorrow.

While I was born in Tel Aviv, I had the privilege of growing up in Chicago for nearly 20 years. I spent my twenties relocating back to Israel to fulfill my dream of living here. While it took some time to get used to the Israeli “chutzpa,” I have and continue to be in awe of the technological advancements this country has contributed to the world.

The Israeli technology ecosystem has matured substantially over the last decade. The metric of huge success is no longer considered a $200-300M exit, rather the centaurs (>$100M ARR), unicorns and the decacorns (>$10B valuation). Today, it’s all about growing global, sustainable organizations. In 2022, we saw $12B in growth financing in Israel which is 85% higher than pre-COVID numbers. Deals above $100M have increased by 80% since then and deals above $50M continued to make up the majority of raised capital (IVC).

The ecosystem has matured in part due to the founders themselves, who have become more sophisticated and experienced. About a third of Founders are second- and third-time entrepreneurs with experience growing great companies, instead of coming straight out of the army or university to build their first company. On the other side of the spectrum, investors have also become more sophisticated. While it’s known that the Israeli ecosystem is excels in early-stage technologies, many of the first-generation VCs have also established growth vehicles in recent years that enable these founders to grow for the long-haul. Not to mention that foreign investment continues to increase as the Israeli high-tech ecosystem is one of the most promising ones worldwide. It’s not a surprise why – Israel is:

- #1 in number of unicorns per capita (5th highest number of unicorns worldwide)

- #1 in number of engineers and scientist per capita

- #1 in R&D expenditure per capita (5.4% of GDP compared to an avg among the OECD of 2.6%)

While Israel has incredible technological strengths, there is still a huge gap for Israeli founders in being able to take their companies from Series A/B to C/D and beyond. Going from being an Israeli entrepreneur to a global business CEO within the U.S. market (typically the target) can be challenging on many levels, especially when there lies both a physical and cultural gap. That’s why it’s so important to bring NightDragon’s NightScale GTM vehicles and programs to help close these gaps and enable the Israeli high-tech ecosystem to continue maturing beyond what anyone imagined. NightDragon’s network is unlike any other and includes dedicated CEOs, CISOs, CTOs, industry leaders, and experts, along with hundreds of partners that engage in cultivated agreements exclusively for the NightDragon portfolio.

The opportunity in EMEA extends beyond the Israeli ecosystem, as well. Cities such as London, Paris and Berlin also have extraordinary high-tech ecosystems, with more than $100B of VC capital raised in 2022, almost twice the levels of 2020. Although we had a turbulent 2022, European M&A remained resilient with the number of M&A deals rising to a record of nearly 18K which is 11.7% higher than an already record-breaking 2021 (Pitchbook). One in ten of these companies was acquired by a North American organization. EMEA startups accounted for 23% of global VC investment, another one of the few statistics out there that shows an increase from the anomalous year of 2021!

I have had the privilege of seeing much of this growth firsthand throughout my career, most recently as VP of Glilot Capital Partners, where I led all aspects of portfolio development and growth for 20+ Israeli enterprise software companies from seed to scale, seven of which were acquired (including Cider Security – acquired by Palo Alto Networks and IntSights – acquired by Rapid7). Additionally, I built and managed the firm’s Advisory Board of 150+ C-Level executives. I have also held positions at Microsoft, working with the Microsoft Accelerator portfolio companies, and Conversant, where I managed client budget and development.

I look forward to now working alongside the proven leadership of Dave, Ken, Morgan, Amy and the rest of the wonderful professionals across the team to help us not only capitalize on the immense investment opportunity that EMEA represents for our firm and its LPs, but also contribute to growing the Israeli tech ecosystem into its next phase through nurturing the next-generation of growth-stage companies towards great success. The opportunity to learn from their decades of operating experience and unique way of thinking is a true privilege.

I invite you to visit our beautiful beaches and delicious restaurants here in Tel Aviv and am always happy to talk, so feel free to reach out! [email protected]